Exit of ‘Helicopter Ben’ from the Federal Reserve hasn’t affected the general trajectory of US monetary policy. One of the architects of Fed’s quantitative easing and subsequent tapering strategy is now at the helms. If any one had doubts about Chairwoman Janet Yellen’s intentions of continuing with the easy monetary policies then this week’s FOMC Statement and press conference dispelled them. S&P 500 made new highs this week. After the FOMC Statement on Wednesday, it pushed above previous week’s high.

Defying all projections and expectations the S&P 500 is continuing to go higher. It has already stretched above the upper limit line of a narrowing up-sloping wedge. Previous such attempts coincided with bonds making a short-term reversal. This time around too the bonds started to make reversal but then Feds stopped it. There is one indicator that is flashing an amber signal. The 9-bar RSI has not made a new high along with high S&P 500. This is keeping the possibility of RSI divergence open.

Week In A Nut Shell

- Another week in June and another up week for the market bucking the historical tendencies. Well, at least for the US markets. Asian and European markets were mixed. Like last week, the 3-month picture is up for all, except Russell 2000. Previously severely depressed markets – Russia, Brazil, Turkey and Spain have done much better in the last three-months. So did Mumbai.

| Week | 3-Month | Week | 3-Month | |||

| North America | Global Dow | +1.1% | +6.8% | |||

| DJIA | +1.0% | +4.0% | ||||

| S&P 500 | +1.4% | +5.2% | Latin America | |||

| NASDAQ | +1.3% | +2.1% | Brazil | -(0.3)% | 15.3% | |

| Dow Transport | +2.0% | +9.2% | Mexico | +0.9% | 7.1% | |

| Russell 2000 | +2.2% | -(0.4)% | ||||

| Europe | Asia & Pacific | |||||

| UK FTSE 100 | +0.7% | +3.4% | Shanghai | -(0.8)% | +0.3% | |

| German DAX | +0.8% | +6.9% | Nikkei 225 | +1.7% | +7.9% | |

| French CAC40 | -(0.0)% | +4.8% | Hang Seng | -(0.5)% | +8.2% | |

| Spain | +0.4% | +11.0% | South Korea | -(1.1)% | +1.7% | |

| Italy | -(0.8)% | +4.8% | Australia | +0.3% | +1.5% | |

| Switzerland | +0.6% | +5.0% | Bombay | -(0.5)% | +15.4% | |

| Russia | -(1.2)% | +22.5% | Indonesia | -(1.6)% | +3.1% | |

| Turkey | -(0.8)% | +21.4% | Thailand | +0.8% | +7.8% | |

- Long term Treasury yields were down but near-term were up. All are still lower than 3 months ago.

| 30 Years Yields | +1.2% | -(4.4)% | 13 Week Yields | -(66.7)% | -(77.8)% | |

| 10 Years Yields | +0.8% | -(4.6)% | 30 Years Bond | -(0.3)% | +2.6% |

- Commodities generally rose for the week. Gold, silver and sugar had big weeks. The 3-Months picture is mixed.

| GSCI Index | +1.3% | +3.0% | |||

| Light Crude | -(0.3)% | +7.2% | Wheat | +1.2% | -(14.4)% |

| Nat Gas | -(3.9)% | +5.6% | Soybeans | -(4.5)% | -(3.4)% |

| Gold | +3.2% | -(1.6)% | Sugar | +10.0% | +11.4% |

| Silver | +6.2% | +2.7% | Coffee | +1.0% | +2.5% |

| Copper | +2.9% | +5.6% | Cotton | +1.4% | -(3.5)% |

| Corn | +0.1% | -(6.6)% | Cocoa | -(0.6)% | +4.9% |

- Forex had a mixed week. Dollar index closed down but was higher mid-week.

| Dollar | -(0.4)% | +0.2% | |||

| EUR/USD | +0.4% | -(1.4)% | AUD/USD | -(0.2)% | +3.4% |

| GBP/USD | +0.3% | +3.2% | NZD/USD | +0.4% | +1.9% |

| USD/JPY | -(0.0)% | -(0.2)% | USD/CAD | -(0.9)% | -(4.2)% |

| USD/CHF | -(0.7)% | +1.3% | AUD/JPY | -(0.1)% | +3.1% |

The Economic Report Card

- Asia-Australia

- New Zealand

- Westpac Consumer Sentiment was in line at 121.

- Current Account was in line at 1.41B

- GDP q/q at 1.0% was lower than forecast of 1.2%

- Japan

- Trade Balance was better at 1.01T expected

- All Industries Activity m/m disappointed at 3.7% expectations

- Australia CB Leading Index m/m came in line at 0.1%

- New Zealand

- Europe

- Euro Zone

- CPI y/y was inline at 0.5%; Core CPI at 0.5%

- Current Account of 21.5B beat the forecast of 19.4B

- ZEW Economic Sentiment of 58.4 was lower than forecast of 59.6

- Italian Trade Balance was worse at 3.51B than forecast of 4.27

- Switzerland

- PPI m/m at 0.1% was higher than the forecast of 0.

- SNB maintained the rates

- ZEW Economic Expectations came in line at 4.8

- Germany

- PPI m/m reading on 0.2% was lower than the forecast of 0.2

- ZEW Economic Sentiment disappointed at 29.8 vs. forecast of 35.2

- United Kingdom

- CPI y/y at 1.5% was lower than forecast of 1.7

- PPI Input m/m disappointed at 0.9% vs. 0.1% expected

- RPI y/y of 2.4% was lower than forecast of 2.5

- Core CPI y/y 1.6% vs.1.7% expecte

- HPI y/y at 9.9% were higher than forecast of 9.1

- PPI Output m/m lower at 0.1% vs. 0.1% expected

- Retail Sales m/m came in line at 0.5%

- CBI Industrial Order Expectations beat at 11 the expectations of 3 0

- Public Sector Net Borrowing was as expected at 11.5B

- Euro Zone

- Americas

- United States

- Empire State Manufacturing Index beat at 19.3 the forecast of 15.2

- TIC Long-Term Purchases disappointed at 24.2B vs. 41.3B expected

- Capacity Utilization Rate of 79.1% was better than forecast of 78.9%

- Industrial Production m/m was inline at 0.6%

- NAHB Housing Market Index improved to 4

- Building Permits disappointed at 0.99M vs. 1.07M expectation

- Core CPI m/m was hotter at 0.3% than forecast of 0.2%

- CPI m/m was higher at 0.4% vs. 0.2

- Housing Starts of 1.00M was lower than forecast of 1.04M

- Current Account of -111B was worse than expected 96B

- FOMC maintained taper level and rates

- Unemployment Claims were 312K as expected

- Philly Fed Manufacturing Index reading of 17.8 surprised on the upside

- CB Leading Index m/m reading of 0.5% disappointed

- Canada

- Foreign Securities Purchases were better at 10.13B vs. 4.27B expected

- Wholesale Sales m/m of 1.2% beat the forecast of 0.3%

- Core CPI m/m were better at 0.5%

- Core Retail Sales m/m reading on 0.7% also beat the forecast

- CPI m/m of 0.5% was hotter than forecast of 0.2%

- Retail Sales m/m was 1.1%, better that forecast of 0.4%

- United States

Technical Perspective

The Fed is acting as the gas-station for the market dispensing with free gas but that doesn’t mean that every index or security is moving at the same speed. Let’s look at the relative performance and possibilities.

- S&P 500 crossed above last week’s high of 1951.27 and closed at all time high of 1962.87 on Friday. Dow Jones Industrial Averages also closed at all time high but it is still at the resistance level.

- DIA is severely underperforming SPY.

- NASDAQ Composite is at the high of 4371.39 made on March 7th. It has yet broken above the upper channel line of a horizontal channel.

- QQQ has been outperforming SPY since early May but recently it started to underperform.

- Russell 200 is a laggard and is still quite below the 2014 high of 1212.82 made on March 4th.

- IWM unperformed SPY from March to June but now is outperforming

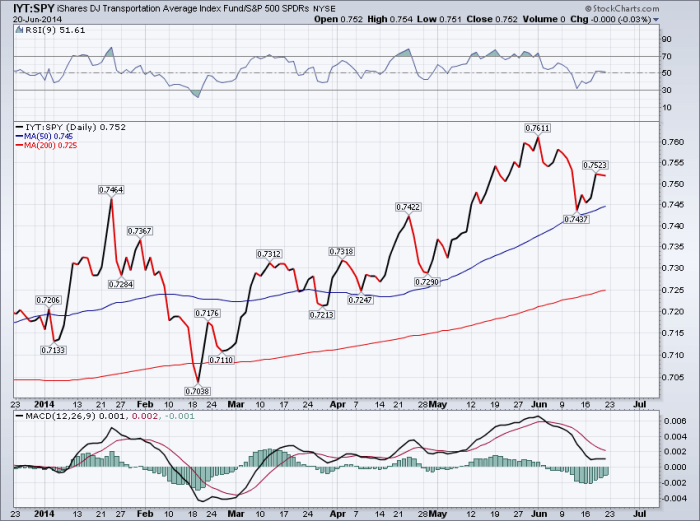

- Dow Transport did not cross above the last week’s high of 8256.79

- IYT was opposite of IWM in comparison to SPY.

- Looking at Intermarket picture, equities are still the better class to be long. Over 3-month period commodities have done well too.

- Compared to S&P 500, Amex Index, Dow Transports and NYSE Composite have done better in the last three months. Russell 2000 joins them for 1-month performance.

- Most of the commodities are underperforming S&P 500. Only Energy and Industrial Metals have outperformed in the last 3-month and none in the last 1-month period.

- In the last 3-month period, XLE has significantly outperformed SPY followed by XLU, XLP and XLI. The performance is similar over 1-month period.

Looking Ahead To The Week Of June 23rd, 2014

Economic Reports

- Sunday 22nd

- Chinese HSBC Manufacturing PMI

- Monday 23rd

- French Flash Manufacturing PPI; Services PMI

- German Flash Manufacturing PPI; Services PMI

- UK BoE Credit Conditions Survey

- US Flash Manufacturing PMI

- US Existing Home Sales

- Chinese CB Leading Index m/m

- Tuesday, 24th

- Swiss Trade Balance

- German Ifo Business CLimate

- UK BBA Mortgage Approvals

- US S&P/CS Composite-20HPI y/y; HPI m/m

- US CB Consumer Confidence

- US New Home Sales

- Wednesday 25th

- GfK German Consumer Climate

- UK Nationwide HPI m/m

- UK CBI Realized Sales

- US Core Durable Goods Orders m/m; Durable Goods Orders m/m

- US Final GDP q/q

- Thursday 26th

- UK Unemployment Claims

- US Core PE Price Index m/m

- US Personal Spending m/m

- New Zealand Trade Balance

- Japan Household Spending y/y

- Japan National CPI y/y

- Japan Tokyo Core CPI y/y

- Japan Retail Sales y/y

- Japan Unemployment Rate

- Friday 27th

- German Prelim CPI m/m

- French Consumer Spending m/m

- Swiss KOF Economic Barometer

- Spanish Flash CPI y/y

- UK Current Account

- UK Final GDP

Earnings / Splits

Some of the planned events of the week

- Monday

- Hertz Global (HTZ), Micron (MU) and Sonic (SONC) to announce earnings after close

- Tuesday

- Carnival (CCL) and Walgreens (WAG) to announce before close

- Apogee Enterprise (APOG) to announce after close

- Bank of Ozarks (OZRK) to split 2:1

- Wednesday

- Apollo Group (APOL), Monsanto (MON), General Mills (GIS), Barnes & Noble (BKS) to announce before open

- Bed Bath & Beyond (BBBY), Herman Miller (MLHR), NW Mobile (NQ) to announce after close

- Thursday

- Accenture (ACN), ConAgra (CAG), Lennar (LEN), McCormick (MKC), Winnebago Inds (WGO), Worthington (WOR) to announce before open

- Inogen (INGN, Nike (NKE), Progress Software (PRGS) to announce after close

- Calgene (CELG) would split 2:1

- Friday

- AZZ Inc. (AZZ), KB Home (KBH) would announce before open

- Middleby (MIDO) to split 3:1; Core-Mark (CORE) would split 2:1

You must be logged in to post a comment.